Learn more about California's new minimum auto insurance requirements.

Don’t Leave A Gap In Your Auto Insurance

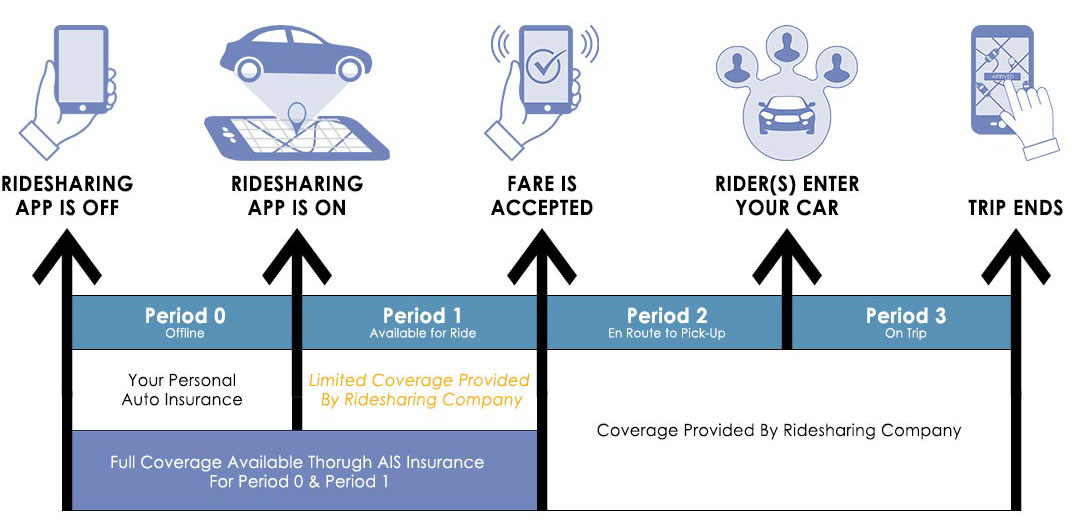

Uber©, Lyft© and other rideshare companies have made it easy to earn an income driving people around. However, there is a period during which the driver is neither protected by the ridesharing company’s policy nor personal Auto Insurance. To cover that lapse in coverage, Rideshare Insurance is designed to complement the insurance that rideshare companies offer drivers.

Understanding Rideshare Insurance

Your Rideshare Insurance coverage can cost you as little as 20 cents per day, depending on the type and amount of coverage. Protect your livelihood and family on a budget that’s right for you.

When You're Covered & When You're Not

How Does Rideshare Insurance Coverage Work?

With the possibility of getting into an accident in Period 1, you may have to pay hundreds or even thousands of dollars out of pocket if you don’t have the proper coverage. Just one single accident can devastate you financially. Rideshare Insurance covers you in Period 1 when the TNC Coverage isn’t in effect. The coverage offered by AIS will pay for costs associated with medical and property liability to other drivers as well as your own vehicle. Call one of our Insurance Specialists at (888) 772-4247 to add Rideshare Insurance to your Auto Insurance policy today.

Additional Insurance Coverages

Wouldn’t it be great to save money insuring your automobile, home, condo, or renters policy with your outdoor vehicles and other assets under one roof? AIS is the insurance specialist who finds affordable coverage for various products. We compare the best rates from our trusted carrier partners, so you know you’re getting the best protection for the best price at no additional charge.

Related Rideshare Insurance Articles

Why Do I Need Rideshare Insurance?

As a rideshare driver, you should be aware that there’s a gap in your coverage. See how Rideshare Insurance covers you when your regular Auto Insurance doesn’t.

Car Insurance Coverages Explained

When you buy Car Insurance, do you know what coverages are included in your policy? Here's a quick guide as to what you're getting with each standard coverage type.

How Is My Auto Insurance Rate Determined?

There are many factors that go into calculating your Car Insurance rate, but it doesn’t have to be a mystery. See what can affect your premium for better or worse.

Top 10 Reasons To Shop Insurance

You may think it takes too long to get just one quote but think again. There are many reasons why shopping around for quotes from a variety of carriers is a smart idea.